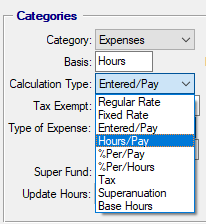

Navigate to Employees > Payroll Admin > Payroll Categories in the main menu and pick a Calculation Type from the drop down menu.

Overview of Pay Calculation Types

Regular Rate

A Payroll Category of this type would be multiplied by the hourly rate on the Employee Pay Setup tab and the number of hours on pay.

Fixed Rate

A Payroll Category with this calculation type will be multiplied by hours on pay.

Entered/Pay

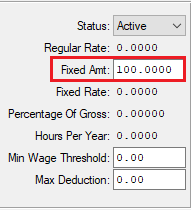

This calculation type is used for Payroll Categories that generally appear as a fixed amount in every pay such as allowances.

Hours/Pay

This calculation type is usually used for calculating entitlements. It looks at the ‘hours per year’ field and computes the Payroll Category based on the pay frequency.

%Per/Pay

A Payroll Category with this calculation type would be computed as a percentage of the gross pay for the period. You will need to populate the following field with the percentage.

%Per/Hours

A Payroll Category with this calculation type would be computed as a percentage of the gross hours for the period. You will need to populate the following field with the percentage.

Tax

This calculation type is saved for tax Payroll Categories. If you have tax scales set up correctly in your database, this category will populate accordingly.

Superannuation

This calculation type is applicable only for Superannuation. You will need to populate the ‘percentage of gross’ field with 9.5% and minimum wage threshold as $450.

Base Hours

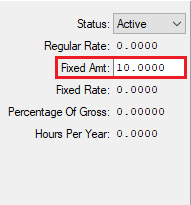

If you set the calculation type as Base Hours for a category, it will look at the base hours worked and multiply it with the fixed amount set below.