Important: This article is only relevant to clients in Australia.

Follow the instructions below to report TPAR through Moveware.

TPAR tells the ATO about payments that are made to contractors for providing services. Contractors can include subcontractors, consultants and independent contractors. They can be operating as sole traders (individuals), companies, partnerships or trusts.

For detailed information on TPAR, please refer to the ATO Document (https://www.ato.gov.au/Business/Reports-andreturns/Taxable-payments-annual-report/).

Process

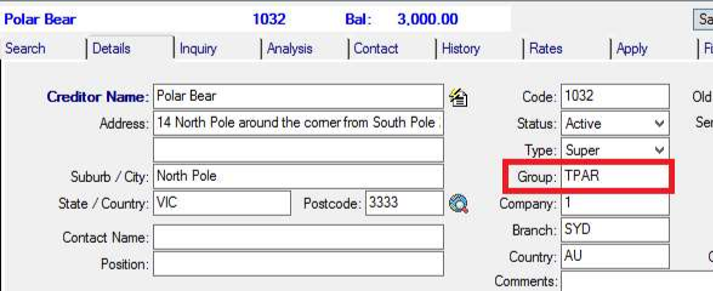

i. To set up suppliers to be included in the Report, go to Suppliers/Creditors > Supplier/Creditor Management. Set the group of the supplier(s) to “TPAR”. This will ensure that the suppliers in this group are always picked up in the Report whether payments have been made to them in that period or not.

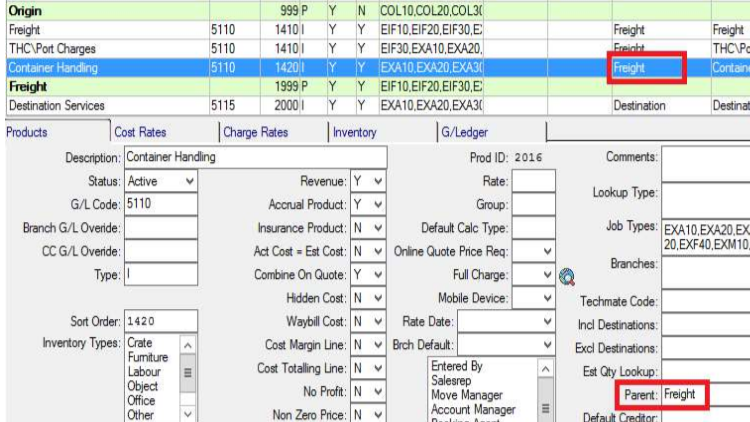

ii. In order to set up Freight products, go to Administration > “Company name” Setup > Supplier/Creditor Products.

iii. Go to the product you wish to have picked up by the TPAR Report. Set Parent as “Freight”. This will ensure the Report only shows payments made for products with “Freight” as the parent.

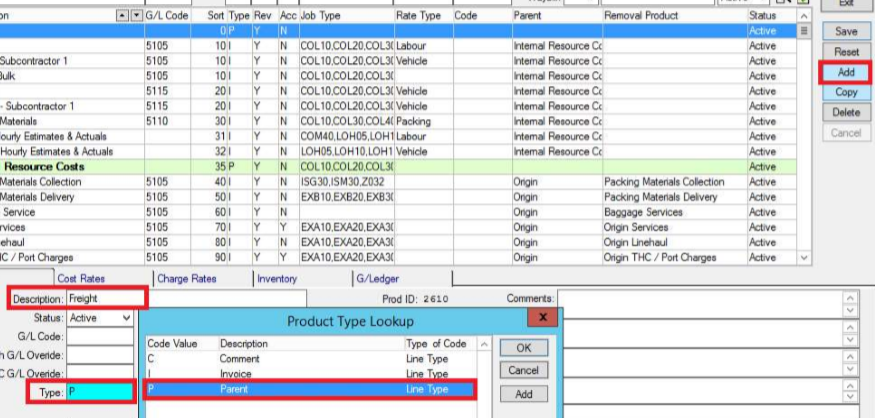

iv. If you don’t have Freight parent set up, you can go to Administration > “Company name” Setup > Supplier/Creditor Products and Add a new product. Put the description as “Freight” and ensure type is set to ‘P’ or parent. After clicking Save, you should be able to look up Freight in the Parent category as shown in Step (iii) above.

v. To run the Report, go to Reports > Suppliers and run Taxable Payments Annual Report.